Both also happen to be the biggest stockowners in IndyMac which is an entity to rob legally taxpayers as the FDIC has put up some very disturbing agreements on loss sharing.

excerpt 1

FDIC Responds To IndyMac/OneWest Video Alleging Sheila Bair Transferred Billions In Taxpayer Funds To Paulson & Co., And Others

A few days ago we posted "The Great Highway Robbery Continues: How the FDIC is Legally Transferring Billions in Taxpayer Money to Hedge Funds" which presented a clip by Think Big Work Small, highlighting what was seemingly a grand scheme to defraud taxpayers with the FDIC's complicity. Today, the FDIC strikes back, issuing a Press Release claiming the video contains "blatantly false claims", "perpetrates other falsehoods" and has "no credibility." The counterargument which is supposed to render all allegations of impropriety false: "OneWest must first take more than $2.5 billion in losses before it can make a loss-share claim on owned assets" and that "in order to be paid through loss share, OneWest must have adhered to HAMP." Unfortunately, reading between the lines of the response indicates that not only are the falsehoods actually truehoods, but the video is still, sorry Shila, quite credible.

So to make sure we get this straight. OneWest could have an accrued loss balance of $2.499 billion as of today, and just one more loss will be enough to force the FDIC to make a lump sum payment instead of linear payments? And somehow we are supposed to be comforted by this? A cursory public filing search for OneWest bank reveals no such organization. Maybe while it is denying the validity of the video the FDIC can advise taxpayers where they can get some information on what the correct reserve or loss accrual at OneWest is? Courtesy of the most opaque accounting rules in the history of America, OneWest could have already gotten way beyond the $2.5 billion threshold and is simply waiting for the proper time to spring this to the unwitting FDIC.

And as for adhering to HAMP? Would that be the same program that will ultimately benefit less than 1% of US first mortgages due to ridiculous constrains that make the vast majority of participants ineligible? Aside from scoring one for the stupidity of the administration, does the FDIC actually believe that Americans will find this to be a relevant gating issue?

Sorry FDIC, but not only did your press release not refute the video's claims in the least, but you just dug yourself an even deeper grave as every aspiring blogger and investigative reporter will now do everything in their power to find comparable examples of blatant "slap in the face" fraud expecting you to retort to any and all allegations, ensuring 15 minutes of fame for all implicated.

From the FDIC press release:

FDIC Provides Additional Information on its Loss Share Agreement With OneWest Bank

February 12, 2010

FDIC Director of Public Affairs Andrew Gray said, "It is unfortunate but necessary to respond to blatantly false claims in a web video that is being circulated about the loss-sharing agreement between the FDIC and OneWest Bank. Here are the facts: OneWest has not been paid one penny by the FDIC in loss-share claims. The loss-share agreement is limited to 7% of the total assets that OneWest services, and OneWest must first take more than $2.5 billion in losses before it can make a loss-share claim on owned assets. In order to be paid through loss share, OneWest must have adhered to the Home Affordable Modification Program (HAMP).The producers of this video perpetuate other falsehoods. The FDIC has not requested to borrow money from the Treasury Department. Indeed, we continue to be funded by the banking industry through assessments, not by taxpayers as claimed in the video.

This video has no credibility. Regardless of the personal or professional motivations behind its production, there is always a responsibility to be factually correct and transparent. The FDIC made available a fact sheet on the day that the sale of IndyMac was announced that details the terms of the contract. It's too bad that the creators of this video opted to premise it on falsehoods."

Those who may have missed the full video, here it is again.

excerpt 2

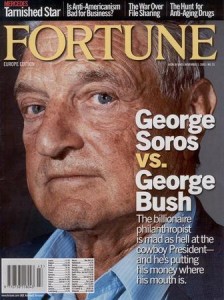

Liberal Billionaire George Soros… Major Shareholder in IndyMac/One West Bank

When it comes to being inflexible and unresponsive to homeowners in need of a loan modification, IndyMac Bank, which has just been renamed “One West Bank,” is legendary.

This is the bank that failed spectacularly in July 2008, was taken over by the FDIC, and ended up costing taxpayers something like $11 billion… give or take… I can’t keep track of billions anymore… I’ve moved on to tracking trillions. And the new buyers of this fire sale financial institution that’s deservedly become the poster child for stupid lending tricks, includes billionaire George Soros.

Soros, along with billionaire Michael Dell and others, agreed to purchase the bank for $20.7 billion.

As of Jan. 31, 2009, IndyMac’s assets totaled $23.5 billion and deposits were $6.4 billion, roughly half the cash and assets the bank had at the time of its failure. The new buyers also got a handy-dandy “loss sharing agreement” from the FDIC, whereby after shouldering the first 20% of any future losses, the FDIC gets stuck with most of the rest. So, I guess you could say they got a deal. A sweetheart of a deal… not to put too fine a point on it.

Considering that kind of taxpayer supported deal, and with so-called liberal philanthropist George Soros as one of the bank’s major shareholders, you might think the new One West Bank would be the last financial institution to be throwing people out of their homes when loan modification would make more sense financially, but you’d be wrong. One West Bank isn’t participating in the President’s program either.

2. Here some instructions how you can join the growing club of millionaires in America 16% year over year - or is that just the real inflation?

IF You Are Going To "Demonstrate"....

Then aim your "demonstrating" at the people who are bankrupting your state - and you personally.

I speak specifically of people such as those that The Daily Illini pointed out - all employees for the University of Illinois.

Let's see what we have here....

The head of the football team - the coach - makes $1 million. For coaching a college football team.

The "intercollegiate (sports) director makes $600,000.

The President of the University is just $50 large shy of a half-million.

A large number of Deans and Professors make $250,000 - or more.

Indeed, I have to get eight pages into this list before I drop below $200,000.

Oh, we also have two Lieutenants in the Police Department that make $192,545 - each - per year. Handing out tickets to scooter riders without helmets and issuing University Parking Citations (probably more than $200,000 worth of those) I'm sure.

Now maybe you can justify how it is that these fine bastions of American Government Employment earn these bloated salaries.

I will point out some demographics to readers for Champaign-Urbana, Illinois, where the University happens to be.

The median home price is $159,900, which the top fifteen pages of these employees can afford to pay cash for with one year's salary.

The median income for a family is $52,628, while per-capita income according to the BEA is $31,354. Fewer than FIFTEEN PERCENT of the persons on the University Payroll make equal to or less than the median per-capita income for the city.

Oh, and let's not discuss retirement benefits. Legacy pensions anyone? How about medical care once one retires. And speaking of which, what's the retirement age?

There has been much written about overblown pensions, double and even triple-dipping and similar games. But this table, nicely sortable by salary, makes quite clear exactly who the system employs and how much they pay - and that the pay is, shall we say, ridiculous compared to the average private-sector prevailing wage.

This much should be clear: If you're curious about why you're being bankrupted with parabolic tuition and fee increases along with demands to take on outrageous amounts of debt to get a so-called "college education", you might discern from the above that the only "educating" you're getting in the UofI system is how to hold still while you're bent over the table and violated.

What you, Dear Student, who is being given the whaaaaambulance treatment by the Administration (the folks making those six-figure salaries that are all radical multiples of the average living wage in your town) do about that "education" is, of course, up to you.

No comments:

Post a Comment